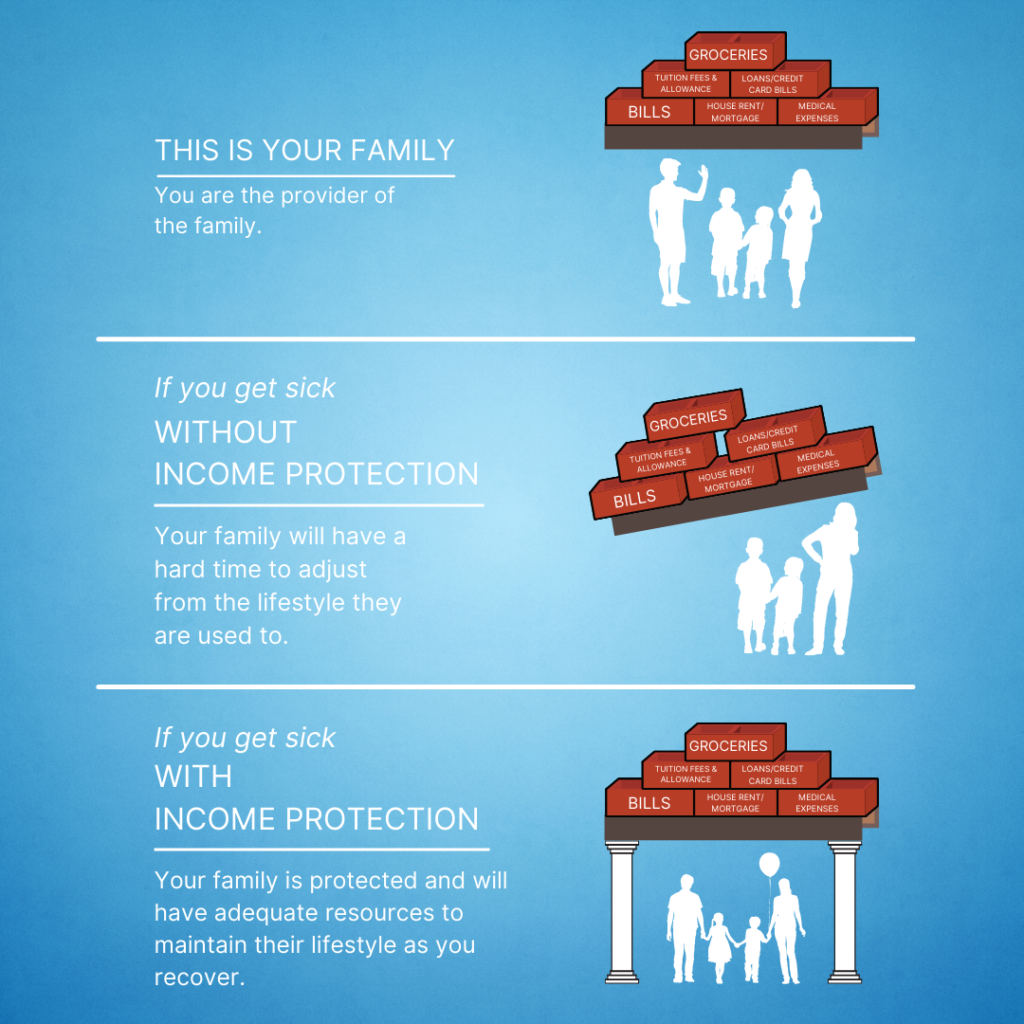

If you received a payout you would pay tax on 75% of the total payment. So if you received a sum of £2,000, you would pay tax on £1,500 at your normal rate. Now, it's worth noting that you could be making payments towards a monthly or annual premium without even knowing - either because you forgot or your employer was unclear - with the.. Like most insurances, income protection insurance acts as a safety net. It provides peace of mind by helping you meet your financial obligations, such as mortgages and bills, when your earning capacity is compromised. Income protection insurance can cover up to 85% of your pre-tax income for a period of time, so it's well worth investigating.

Do You Have Protection Insurance? You Should

protection insurance protection insurance explained 2023 YouTube

Protection Insurance Australia Coverage & Cost Business Blog

Why You Need Protection Insurance SYS Group

Protection Insurance Do you really need it?

protection insurance concept icon 3092741 Vector Art at Vecteezy

What is Protection Insurance? You Need to Know N4GM

What Is Protection Insurance? YouTube

protection insurance

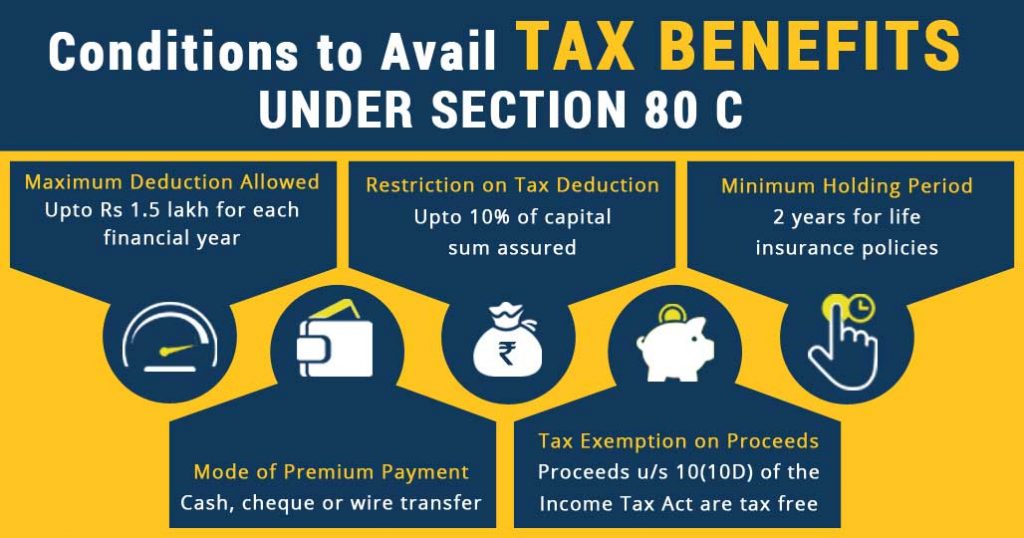

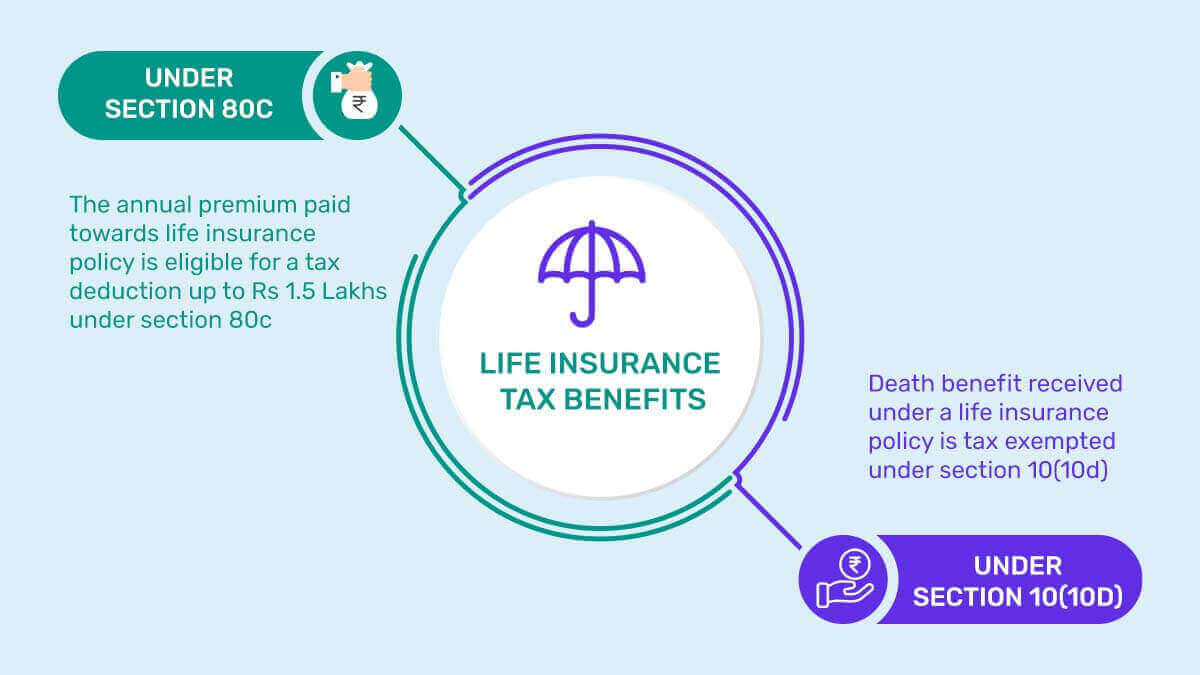

Life Insurance Policy and Tax Benefits

Protection Insurance Guide Definition, Coverage, Suitability, Pricing, Taxation

Life Insurance Tax Benefits in India 2024 PolicyBachat

protection insurance not just about the amount you earn • News • Acorn Financial

The Importance of Protection Insurance Brookfield Finance

Life and protection insurance tax deductions explained

Which is the best protection insurance? — Woodward Financials

Protection Insurance FreePTETest

Life Insurance Benefits Taxed It Is Commonly Known Fact And Widely Utilized Tool That Life

Protecting Your Smart Finance

Top 5 tax benefit questions asked by insurance buyers Mintpro

An income protection insurance policy covers for the loss of salary or wages due to illness or accidents. The amount of the payments you receive is a percentage of your earnings based on your employment income prior to a claim. Policies may be personal accident insurance, sickness insurance or a combination of both, usually named income.. Income protection insurance is a type of insurance that pays out if you're hurt or sick and can't work.. In the U.S. income protection insurance is more commonly called disability insurance, but it's essentially the same idea as the income protection insurance you'll find in the U.K., Australia, and New Zealand.. It's a simple concept: You buy a policy based on the income you're.